Quick post on T1 Energy Inc

Current upside of 400% in 2-3 years

Disclaimer - Not investment advice. Educational content only. All calculations are high-level calculations intended to estimate potential. A more detailed deep dive will follow.

T1 Energy TE 0.00%↑ is a U.S.-based solar manufacturer building domestic solar module and cell capacity to benefit from the energy transition and IRA incentives.

Key Points:

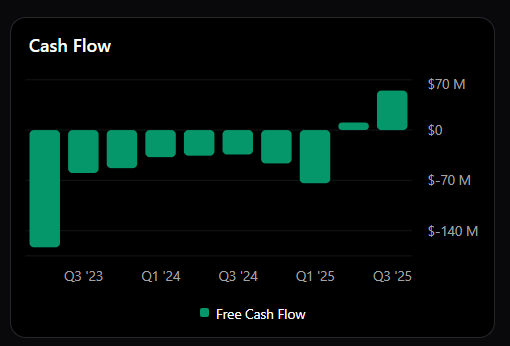

Their first factory, G1 Dallas, which manufactures solar modules using imported cells, began ramping up in Q2 2025, making the company cash flow positive with accelerating momentum.

A second facility, G2 Dallas, is planned to manufacture solar modules with domestically produced solar cells. This factory is expected to come online in 2026, with a meaningful ramp-up beginning in 2027.

Financial Projections:

2025 EBITDA: $25-50M

2027/28 EBITDA: $650-700M (a 13-26x increase)

Valuation Framework: Using First Solar’s 13.5x EV/EBITDA multiple on the projected $650-700M EBITDA gives roughly $8.8-9.5B market cap versus the current $1.8B, implying significant upside of 390-428%

Risks: There is still execution and funding risk, but they have deeply reduced

Credits: This stock was recommended by Hitesh (https://x.com/hiteshkar). Do give him a follow on X.