BitMine Immersion Technologies — 170% upside by Dec 2025

The Ethereum Treasury Play (PT: $120 by Dec 2025 from $44.5 currently)

Disclaimer: This information is for educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the content as such.

Executive Summary

BitMine Immersion Technologies ( BMNR 0.00%↑ ) is building the largest institutional Ethereum (ETH) treasury in public markets. BMNR owns about 1.87 million ETH plus cash and some BTC, and explicitly aims to consolidate a “category-king” position—similar to what MicroStrategy did for Bitcoin, but for Ethereum. The combination of (1) federal stablecoin rules that make on-chain dollars enterprise-ready, (2) spot ETH ETF inflows that remove coins from circulation, and (3) a race among public companies ( BMNR 0.00%↑, SBET 0.00%↑, BTBT 0.00%↑) and ETH ETFs to stockpile ETH creates a favorable supply-and-demand setup for ETH. BMNR then layers on capital-markets tools (accretive issuance, staking/overlays, options, financing, buybacks) that plain ETH or an ETH ETF can’t use, supporting a premium to NAV (mNAV) through the cycle.

Price Target (Dec-2025): $120.

Assumptions: ETH at $8,000; 1.5× NAV multiple; modest dilution to fund continued ETH purchases.

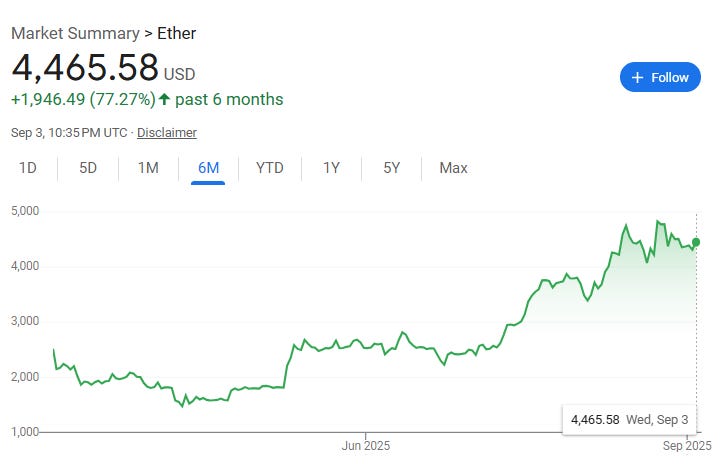

Section 1: Why ETH now?

1) The GENIUS Act makes on-chain dollars “board-ready”

The GENIUS Act (enacted July 2025) is the first U.S. federal rulebook for USD-backed stablecoins (1:1 reserves, disclosures, compliance). That reduces the “headline risk” and uncertainty that kept CFOs and banks on the sidelines. Most regulated stablecoins—and the deepest liquidity and tooling—sit on Ethereum, so real-world usage tends to show up there first.

Before GENIUS Act., rules were patchy, banks weren’t sure whether you could touch them, and there was prosecution by the governmental agency. This is all has now gone away and created a pathway for global adoption.

2) Cheaper Layer-2s unlocked by Ethereum’s Dencun upgrade

The Dencun (EIP-4844) upgrade in March 13, 2024 introduced “data blobs” that dramatically reduced Layer-2 costs. Lower fees make enterprise-grade use cases (payments, B2B settlement, tokenized Treasuries, compliant DeFi) commercially viable at scale. More usage → more ETH burned via EIP-1559 base fees → tighter supply dynamics over time.

Section 2: Why ETH will rise now?

ETFs and treasuries are soaking up supply

Spot ETH ETFs now hold a multi-million-ETH stack (roughly ~5% of total supply). Monthly flows set fresh records in July 2025 and remained strong through August despite day-to-day noise. The key point here is new ETF dollars must buy ETH, mechanically shrinking the liquid float.

Treasury buyers are joining in.

• BMNR: ~1.87M ETH today with additional cash earmarked for more and achieved this in ~2 months

• SBET (SharpLink): reported ~837k ETH after aggressive weekly purchases via its ATM.

• BTBT (Bit Digital): disclosed a pivot to an ETH-treasury model with ~120k ETH.

Together, these corporate stacks already represent a meaningful share of liquid ETH, and their stated intent is to keep buying.

Why that matters: ETH has a fixed-ish float near term. It can dilute by a maximum of 1.5% per year based on transaction volumes but fixed in the near term. A large portion is staked (not actively trading). When ETFs and treasuries absorb coins on top of that, fewer are available for everyone else—supporting upward price pressure if demand persists.

Section 3: New stablecoin use cases

Regulatory clarity doesn’t just increase adoption—it changes what’s feasible and how companies are already using it:

Automated corporate cash ops

24/7 programmable payables/receivables, payroll streaming, and auto-sweeps into tokenized T-bills or money-market funds like Stripe takes USDC on Ethereum/L2 so businesses can accept/settle online instantly; PayPal’s PYUSD supports vendor payouts, while treasurers sweep idle balances into BlackRock BUIDL or Franklin Templeton’s on-chain MMFs for same-day yieldB2B & cross-border settlement

Same-minute USD settlement, cheaper FX via stablecoin pairs, on-chain proofs for audits and disputes like Visa settles with acquirers in USDC (e.g., Worldpay, Nuvei) and with Crypto.com—compressing days to minutes; Shopify + Coinbase enable USDC on Base so merchants get on-chain dollars with instant, auditable receiptsOn-chain repo & collateral

Tokenized Treasuries and stablecoins as collateral with real-time margining and atomic settlement like Visa settles with acquirers in USDC (e.g., Worldpay, Nuvei) and with Crypto.com—compressing days to minutes; Shopify + Coinbase enable USDC on Base so merchants get on-chain dollars with instant, auditable receiptsIoT & micro-commerce

Machines paying machines for data/compute/bandwidth with policy-limited streaming dollars like DIMO (connected-car network) on Base pays devices for driving data; Superfluid/Sablier let teams stream USDC per second for APIs, grants, or bandwidth—turning tiny, frequent payments into workable unit economicsReg-compliant DeFi

Whitelisted pools, policy-based wallets (account abstraction), and ZK-KYC let institutions tap on-chain liquidity under a rulebook like Aave Arc and Maple run KYC-gated, institution-only pools; Backed (tokenized securities) and Ondo (OUSG) provide KYC’d, Ethereum-native exposure to stocks/UST bills that doubles as cash management or collateral.

Bottom line: These are now board-presentable, not just pilots. And they largely accrue to Ethereum, where stablecoin liquidity and tooling already live.

Section 4: Why BMNR 0.00%↑ over others

1) Why Tom Lee’s brand matters (and can lift BMNR’s multiple)

The messenger moves the multiple. Tom Lee—a high-trust, high-frequency voice on mainstream financial media—does three things for BMNR:

Shrinks the trust gap: Reframes BMNR as the institutional ETH treasury vehicle.

Expands the buyer set: Media exposure → clips → social → research coverage → options market making → deeper liquidity.

Anchors the framework: A simple, repeated yardstick—ETH/share × ETH price × mNAV—gives investors a shared way to value the stock.

That awareness can produce a premium to NAV. When a premium exists, small, frequent ATM issuances can be accretive (NAV/share rises), funding more ETH while increasing per-share value—something ETFs can’t do because arbitrage collapses premiums.

2) Why BMNR can trade above NAV vs. owning ETH or an ETH ETF

BMNR offers ETH exposure plus corporate levers:

Accretive issuance (ATMs) when trading >1.0× NAV → NAV/share goes up.

Yield stacking on the treasury: ETH staking plus conservative basis/option overlays to add incremental yield.

Listed options on BMNR broaden participation (vol funds, structured notes), often supporting higher sustained mNAV via deeper two-sided liquidity.

Balance-sheet engineering: convertibles + call spreads (finance growth with controlled dilution), buybacks when <1.0×, ETH-secured credit for flexibility.

Strategic deals: co-investments/warrants in infra (custody, L2s, tokenized money markets) that create non-ETH sources of value.

Category-leader scarcity: consolidating the “institutional ETH treasury” slot can merit a scarcity premium in risk-on markets.

3) NAV multiple precedent: why 1.5× is reasonable

Digital-asset treasuries have sustained premiums to NAV in past cycles:

MicroStrategy/“Strategy” (BTC) has often traded ~1.3×–2.0×+; peaks higher in euphoria.

MetaPlanet (BTC) has printed >2× in strong windows.

BMNR has comparable or better ingredients for ETH (yield potential, liquidity, narrative leadership). A 1.5× target mNAV is not heroic.

4) BMNR’s positioning (the “Alchemy of 5%”)

Holdings: ~1.87M ETH, plus cash (hundreds of millions) and some BTC.

Intent: Consolidate the institutional ETH treasury category—ultimately targeting a high-single-digit % of total ETH over time if accretive capital is available.

Validation: Regular investor updates, heavy trading liquidity, options available, and visible chairmanship/communications cadence.

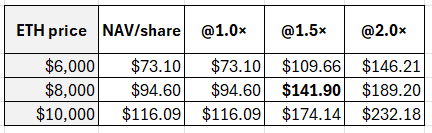

Section 5: The simple math behind the price target

Assumptions: shares ~174M; ETH holdings 1.87M; other assets ~$1.5B (cash + BTC).

If ETH = $8,000:

ETH value = 1.87M × $8,000 = $14.96B; plus other = $16.46B total.NAV/share: $16.46B ÷ 174M = $94.60.

Target @ 1.5× NAV: $141.90.

Conservative PT: $120 by Dec-2025 (allows for modest dilution to fund more ETH). If dilution happens when NAV is >1, it makes ETH per share more valuable

Quick scenario map (same share count, same “other” for simplicity):

Risks

ETH price risk: Drawdowns reduce NAV and can compress the premium.

mNAV compression: Risk-off, execution slippage, or unclear disclosures can push BMNR <1.0×, limiting accretive issuance.

Regulatory risk: The GENIUS Act is a foundation; further rulemaking could slow enterprise rollout or change economics.

Treasury/overlay execution: Staking/derivatives mistakes can add P&L volatility.

Key-person/brand risk: Over-reliance on one spokesperson or narrative channel.

Conclusion

BMNR is more than ETH beta: it is a capital-markets vehicle built to compound NAV/share and sustain an mNAV premium by combining a large ETH treasury with accretive issuance, staking/overlays, options-enabled liquidity, smart financing and Tom Lee’s ability to market his investment vehicle. With federal stablecoin clarity, ETF accumulation, and cheaper L2 rails, the setup supports ETH ↑, NAV/share ↑, and mNAV > 1.0× into 2025.

Disclaimer: All information provided herein by Singularity Research Fund is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Singularity Research Fund may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

I'm glad this wasn't published earlier.