1000% return in 90 days?

Etherium treasury strategy is the flavor of the season

Disclaimer: All information provided herein by Jina Capital is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Jina Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Stablecoins (generally pegged 1:1 to the US dollar) are gaining significant traction due to low or no transaction fees and faster payment processing. Pro-crypto regulations like the GENIUS Act are further accelerating adoption. We see two primary scenarios where stablecoins will continue gaining momentum: crypto-related payments and international transactions. However, we don't anticipate consumers abandoning credit card rewards for stablecoins in everyday transactions anytime soon.

The Network Battle

Stablecoins operate across various blockchain networks, including Ethereum, Solana, and TRON. Ethereum currently holds the largest market share at approximately 60%, but its dominance is declining. The reason? Ethereum charges gas fees (transaction fees) ranging from 0.3-4%, while competing networks like Solana, Polygon, and TRON offer free transactions, attracting cost-conscious users.

The Ethereum Staking Opportunity

Here's where the story gets interesting. Ethereum holders can stake their tokens to validate transactions and earn annualized yields of 3-7%. Currently, 30% of all Ethereum gas fees come from stablecoin transactions. This creates a powerful dynamic where companies are pivoting to become "Ethereum treasury companies," making money through staking rewards.

The Hype Cycle Play

The combination of stablecoin regulation hype and staking opportunities is driving certain stocks to extreme valuations. We believe this is a hype cycle that could last until October, despite our view that Ethereum won't survive as the primary stablecoin network long-term.

Recent examples include:

Sharplink Gaming Inc ( SBET 0.00%↑ ): $3 to $80 in under a week

BMNR 0.00%↑ (Tom Lee as chairman): $4 to $150 in 4 days

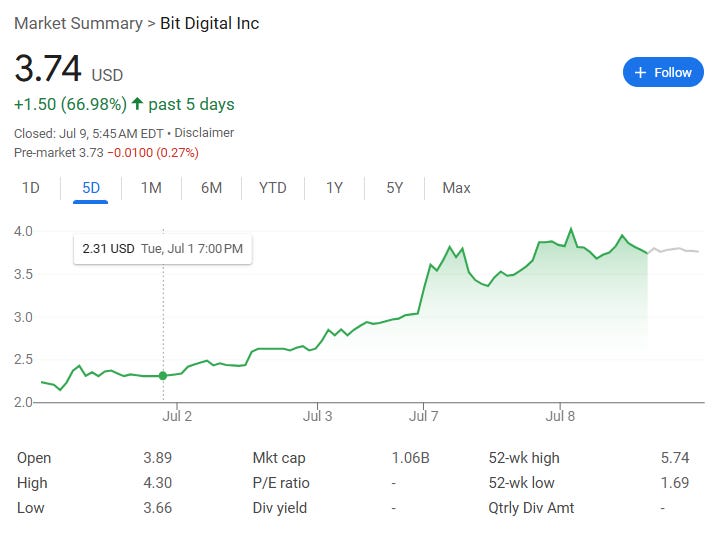

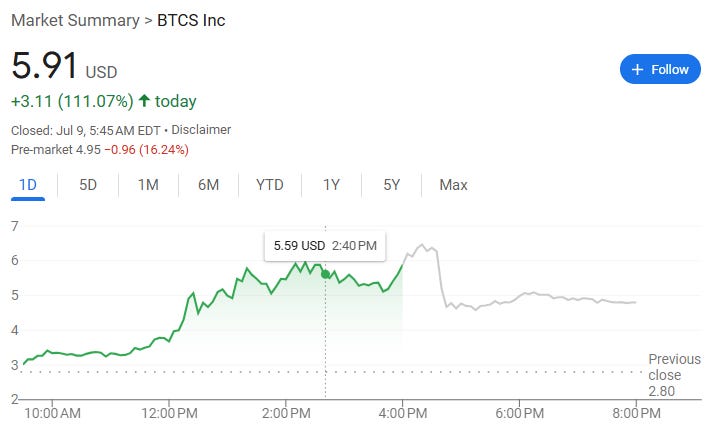

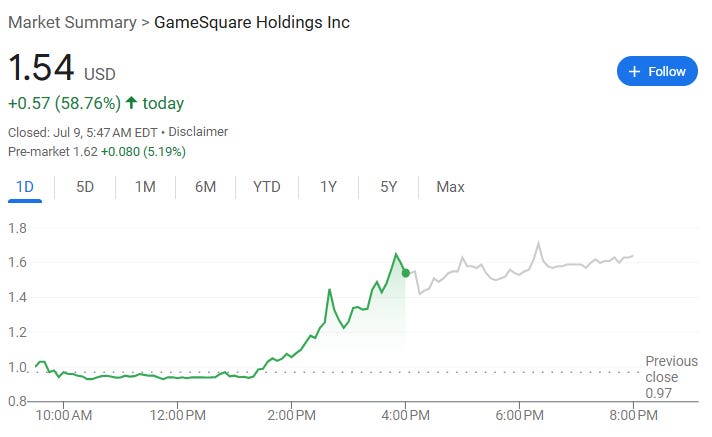

Other notable jumps: BTBT 0.00%↑, BTCS 0.00%↑, GAME 0.00%↑

The general pattern suggests stocks tend to reach at least 2X the Ethereum amount raised by the company.

Action Plan

Set up Google Alerts for "Ethereum treasury" and follow this strategy:

Invest immediately when a company announces etherium treasury plans (only risk what you can afford to lose)

Target 2X-3X returns based on Ethereum holdings

Sell immediately upon hitting your benchmark

This alpha opportunity may last only weeks or months. Execute this strategy on 3 sequential treasury announcements, and 1000% returns become mathematically possible.

Additional Opportunity: Golden Dome Program

The Big Beautiful Bill allocated $25B to the Golden Dome program, benefiting several suppliers including ONDS 0.00%↑, SRFM 0.00%↑ and FEIM 0.00%↑. FEIM 0.00%↑ hasn't shown significant movement yet and could present an interesting earnings play worth deeper investigation.

Remember: These are high-risk, speculative plays.

"Ethereum won't survive as the primary stablecoin network long-term" - may I ask you to elaborate? Thanks!